WEDNESDAY AGGREGATE: Integrated Resource Planning; Transportation Electrification; Long-Term Gas Planning

Hello. Below are some notable CPUC items on our radar this week.

Integrated Resource Planning

CPUC President Alice Reynolds issued a scoping memo and ruling in the new Integrated Resource Planning docket. Key milestones anticipated by this ruling include:

- A February 2026 decision on near-term procurement and 2026-2027 CAISO Transmission Planning Process portfolios;

- Load-serving entities' IRP filings in May 2026;

- 2026-2027 Preferred System Plan development; and

- April 2026 utility Bundled Procurement Plan updates.

The scope also anticipates coordinating implementation of the Reliable and Clean Power Procurement Program (RCPPP) if adopted, and evaluating compliance with prior procurement orders (including backstop procurement) if needed.

Transportation Electrification

Administrative Law Judge Poirier issued a proposed decision to tighten and simplify the state's Transportation Electrification framework.

The PD consolidates multiple reporting requirements into one annual TE compliance report that is due annually on June 30. The PD eliminates the annual Vehicle Grid Integration stocktake adopted in a 2020 decision, D.20-12-029) and shifts any future VGI reporting refinements to a Q1 2026 forum. Recall that the stocktake was intended to give the CPUC and stakeholders a clear picture of the current breadth of TE and VGI efforts. (A "repository of information" as the Vehicle-Grid Integration Council has said.)

The PD continues the "Technical Assistance Program" (which was established in 2022) with a $36 million, three-year budget, which is now fully decoupled from the paused "Funding Cycle One Behind-the-Meter Rebate Program." The PD stipulates that investor-owned utilities can recover pre-pause implementation costs from the latter program.

Last, the PD removes the vehicle purchase requirement from Funding Cycle Zero medium- and heavy-duty programs to lower participation barriers but keeps the December 31, 2026 sunset date. These programs include PG&E's EV Fleet program, SCE's Charge Ready Transport program, and SDG&E's Power Your Drive for Fleets Program.

The earliest the Commission will consider this item is December 4. Comments are due November 17.

Long-Term Natural Gas Planning

SoCalGas recently provided a summary of the CPUC's September 22 workshop in the Long-Term Natural Gas Planning workshop. The workshop focused on how California will forecast, plan, and decarbonize its gas system on a tight Senate Bill 1221 timeline. Recall that SB 1221 requires the CPUC to create neighborhood decarbonization zones that enable utilities to decommission gas infrastructure when at least 67% of customers in such a zone opt to electrify.

Regulators, utilities, and advocates agreed that demand forecasts and rate signals are the hinge points of the gas transition.

Modeling from the California Energy Commission described how forecasts shape system design, while the Utility Reform Network, the Natural Resources Defense Council, and the Sierra Club pushed for non-pipeline alternatives (NPAs), i.e., targeted electrification projects treated as regulatory assets instead of sunk pipeline costs.

SoCalGas framed NPAs around safety and cost control; the City of Long Beach highlighted real-world electrification barriers in aging neighborhoods; and PG&E shared mixed results from its Alternative Energy Program (a pilot meant that electrifies entire neighborhoods or zones in lieu of replacing at-risk gas infrastructure) and Zonal Equity Electrification Program, a companion pilot focused on the equitable implementation of zonal electrification. While these projects electrify whole zones, they struggle to hit the 67% opt-in threshold.

Tensions documented in SoCalGas's report include who pays, how costs are structured, and how quickly pilots will scale.

Electrification

The CPUC issued a proposed decision to launch a Mobilehome Park Electrification Pilot Initiative. The PD directs PG&E, SCE, and SDG&E to work with the CEC's Equitable Building Decarbonization Program to fully electrify select mobilehome parks.

The pilot pairs utility-funded 200-amp service upgrades with CEC-funded behind-the-meter electrification, including heat pumps and induction appliances. All participating parks are required to permanently abandon natural gas.

Priority will go to parks with existing utility service in under-resourced communities with full resident participation. Existing ratepayer funds will be used for these pilots.

The earliest the CPUC will consider this item is November 20. Comments are due November 6.

Wildfire Non-Bypassable Charge

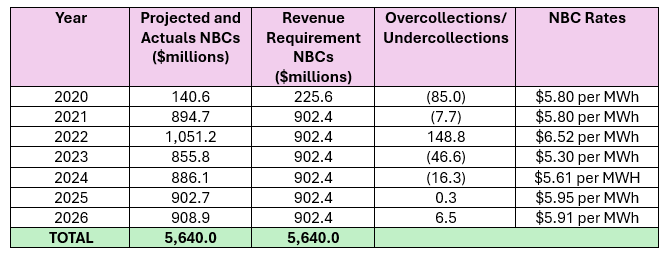

A new proposed decision from ALJ Brandon Gerstle establishes the 2026 Wildfire Fund Non-Bypassable Charge (WF NBC) at $0.00591/kWh, effective from January 1 through December 31, 2026, to collect $908.9 million. This amount reflects the statutory annual revenue requirement of $902.4 million under Assembly Bill 1054 plus $6.5 million in a projected undercollection from previous years.

AB 1054 established the WF NBC to provide a stable funding mechanism for California's Wildfire Fund, with PG&E, SCE, and SDG&E collecting and remitting funds to the Department of Water Resources (DWR). Since 2020, the CPUC has set the charge annually based on DWR's notices and revenue forecasts, via a collection-curve methodology to ensure revenue sufficiency. The rate has fluctuated slightly over time due to load forecasts and prior-year vacancies.

The table below lists the NBC rates dating back to 2020.

The PD orders each IOU to file a Tier 1 advice letter by December 31, 2025 to implement the new charge. The earliest the CPUC will consider this item is December 4. Comments are due November 13.

Wildfire Mitigation

The Public Advocates Office at the CPUC (Cal Advocates) filed an application for rehearing of a decision last month (D.25-09-008), which authorized $1.064 billion in cost recovery for PG&E's wildfire mitigation work. Cal Advocates argues that D.25-09-008 misapplied the law by accepting weak evidence and ignoring precedent.

Cal Advocates contends that the CPUC wrongly relied on an Ernst & Young audit that only checked for accounting accuracy, and not whether costs were incremental to PG&E's General Rate Case. Cal Advocates argues further that D.25-09-008's acceptance of journal entries as proof of cost reasonableness is inadequate.

The application for rehearing points to a SCE wildfire decision from last summer (D.25-06-051), where the Commission distinguished incrementality from reasonableness. By blurring that line, Cal Advocates argues, the PG&E decision risks double recovery. Cal Advocates also disputes PG&E's claim that balancing accounts inherently ensure fairness, noting that "Safety Infrastructure Protection Team" costs were largely existing labor.

Cal Advocates asks the CPUC to reverse its cost-recovery approval and apply a proper legal standard.

Public Purpose Program

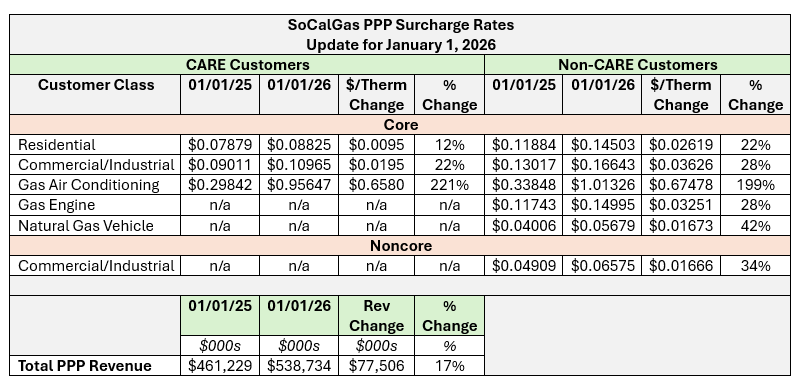

SoCalGas filed Advice Letter 6552-G (available here) to update its Public Purpose Program surcharge rates effective January 1, 2026. The update is required annually under a 2004 CPUC decision (D.04-08-010) and Assembly Bill 1002, which direct the Commission to establish a natural gas surcharge to fund energy efficiency, low-income assistance, and research & development programs.

The new rates are based on the adopted volumes and allocations from a decision last year (D.24-07-009) in SoCalGas's 2024 Cost Allocation Proceeding.

The 2026 surcharge revenue requirement is projected to increase by $78 million (17%) compared to 2025, primarily due to a reduction in the CARE Energy Account overcollection amortization and higher CARE subsidy forecasts.

Program budgets include:

- $233.6 million for CARE;

- $122.5 million for Energy Savings Assistance;

- $180.2 million for energy efficiency (including Regional Energy Networks, market transformation, and CHEEF financing); and

- $12.2 million for RD&D.

SoCalGas's adjustments also reflect amortizations from balancing accounts, including refunds from the Direct Assistance Balancing Account and minor overcollections and undercollections in the Research, Development, and Demonstration Gas Surcharge Account and the San Joaquin Valley Disadvantaged Communities Balancing Account.

Revised PPP rates apply to both CARE and non-CARE customers across major classes, with notable increases for residential and commercial/industrial customers. Please see the table below for more detail.

Biomethane

SoCalGas filed an application to develop a woody biomass pilot project under Senate Bill 1440, which would convert almond orchard waste into bio-synthetic natural gas (Bio-SNG).

The selected developer, West Biofuels LLC, would build and operate the facility in Fresno and Kern Counties, producing about 750 MMbtu/day of biomethane for injection into SoCalGas's pipeline at Vasalia.

The project would be funded with $19.7 million in Cap-and-Trade Proceeds. SoCalGas claims it would achieve a carbon intensity as low as −104 grams of carbon dioxide equivalent per megajoule with carbon capture, which would support state climate goals and create community benefits.

SoCalGas plans to cover utility infrastructure costs and potentially enable a virtual pipeline for future Renewable Natural Gas producers.

SoCalGas's Projected January 1, 2026 Natural Gas Transportation Rates

SoCalGas recently filed Advice Letter 6548-G (available here), its Annual Regulatory Account Balance Update, which projects the company’s revenue requirement and natural gas transportation rates, effective January 1, 2026.

Note that this is SoCalGas’s initial consolidated update – a final, more comprehensive version will be filed in late December. Please see our October 27 summary for more details.