WEDNESDAY AGGREGATE: PG&E ERRA Forecast; Demand Response; Energy Efficiency

Wednesday's offering takes a look at:

- Opening comments on the proposed decision addressing PG&E's 2026 ERRA Forecast, which feature a divide over banked Renewable Energy Credit valuation that carries immediate Power Charge Indifference Adjustment rate implications for Community Choice Aggregator customers;

- An Energy Efficiency staff proposal to significantly expand the gas measure phase-out beyond new construction into retrofits and equity segments;

- More ex parte communications between the investor-owned utilities and CPUC personnel, where the IOUs argue that the Commission's pending Cost of Capital PD sets ROEs too low given current wildfire risk and rising interest rates; and

- Reply comments in the Commission's Demand Response rulemaking, which reveal tensions over scope, cost-effectiveness authority, and Virtual Power Plant integration.

PG&E Electric Rates

PG&E and CalCCA recently responded to the CPUC's proposed decision addressing PG&E's 2026 Energy Resource Recovery Account Forecast. As currently drafted, the PD would authorize PG&E’s $4.511 billion gross requirement.

PG&E's Comments

PG&E supports the PD but requests several clarifications and corrections. Its primary concern is the PD’s adoption of SCE's Slice-of-Day methodology for Resource Adequacy valuation in the Power Charge Indifference Adjustment framework. PG&E asks the CPUC to explicitly state that Slice of Day applies only to energy storage resources for 2026 ratesetting, arguing that the record does not support extending the method to other resource types.

PG&E argues further that the proper valuation for pre-2019 banked Renewable Energy Credits is zero, and that the PD should adopt this permanently rather than on an interim basis. PG&E contends that:

- These Renewable Energy Credits have already been fully valued under historical ratemaking;

- Compensating them again would violate bundled-customer indifference and the company’s approved tariffs; and

- Treating them as having value would undermine the affordability benefits of selling Renewables Portfolio Standard resources.

CalCCA's Comments

CalCCA’s comments oppose several elements of the PD, particularly the PD’s acceptance of PG&E’s zero-valuation for pre-2019 banked Renewable Energy Credits.

- CalCCA asserts that the PD violates Public Utilities Code, which requires that departed load customers receive the value of benefits associated with PCIA-eligible resources. CalCCA argues that PG&E’s proposal impermissibly shifts costs to Community Choice Aggregator customers by denying them compensation for Renewable Energy Credits they originally funded and that PG&E now uses for bundled RPS compliance.

- CalCCA notes that the PD reverses recent Commission precedent (including the 2025 PG&E ERRA decision) without explanation, and that the “interim” nature of the PD does not cure the legal defect or protect customers from significant near-term bill increases.

- CalCCA proposes that the Commission require PG&E to continue valuing banked Renewable Energy Credits under the long-standing RPS Adder approach, to exhaust post-2019 banked RECs before using pre-2019 RECs, and to track all 2025 and 2026 REC usage so future PCIA guidance can apply consistently.

- CalCCA also raises concerns with the PD’s adoption of the Slice-of-Day methodology. While CalCCA does not oppose implementing SCE’s Slice-of-Day method on an interim basis, it requests that PG&E be required to file ann advice letter showing how it will implement SCE’s method, given PG&E’s reluctance to operationalize it and the absence of presented outputs.

- CalCCA also asks the Commission to memorialize an uncontested point from discovery: namely, that data-center load located in CCA territory defaults to CCA service unless already served by an Electric Service Provider.

Instant Analysis: These comments showcase a significant divide over indifference, valuation, and interim methodology. PG&E seeks targeted clarifications to narrow the PD (especially limiting Slice-of-Day to storage and locking in a zero-dollar value for pre-2019 banked Renewable Energy Credits), a change that benefits bundled customers and stabilizes its Renewables Portfolio Standard strategy.

CalCCA counters that the PD’s REC treatment constitutes an unlawful cost shift, reverses recent precedent without explanation, and would drive significant PCIA increases for CCA customers. CalCCA also presses for enforceable implementation of SCE’s Slice-of-Day method and asks the Commission to preserve the longstanding REC-valuation framework pending the PCIA rulemaking.

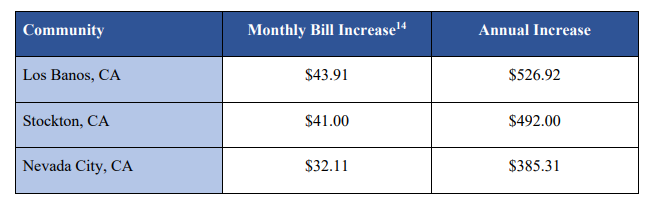

The Commission must now decide whether to preserve the PD’s bundled-leaning structure or adopt CalCCA’s corrections to avoid immediate cost impacts on departed load. (Below are sample rate impacts projected by CalCCA if the PD were to be adopted as-is.)

Energy Efficiency

A new ALJ ruling in the CPUC’s Energy Efficiency rulemaking invites party comments on a staff proposal that would significantly expand the phase-out of ratepayer-funded incentives for natural gas energy efficiency measures.

- The proposal builds on a 2023 decision (D.23-04-035), which already ended incentives for many new-construction gas appliances, and recommends extending this phase-out to retrofits and the equity segment, while tightening the conditions under which any gas-burning measures remain eligible.

- Staff propose defining a "Viable Electric Alternative" as an electric measure that provides the same function as a gas measure and is cost-effective for the customer. To determine this, they recommend using the "Participant Cost Test," which captures bill impacts, upfront costs, and panel-upgrade needs—instead of relying solely on the broader Total Resource Cost Test. The proposal incorporates findings from a statewide market study showing how often electrification requires panel upgrades and how much those upgrades cost.

- Developers seeking EE incentives would need to follow Title 24 prescriptive baselines, which generally require heat pumps for HVAC and water heating. If a Viable Electric Alternative exists, incentives for that gas measure would end in new construction regardless of Total Resource Cost Test results, and in retrofits if the gas measure is not cost-effective. Exempt “non-burning” gas-saving measures remain eligible. Staff also propose new pilot programs to reduce refrigerant emissions and recommend allowing separate incentives for electrification-enabling infrastructure.

Instant Analysis: This move would reorient energy efficiency toward electrification, customer economics, and long-term decarbonization. If adopted, the proposal would reshape measure eligibility, program design, and administrator incentives across the next decade. Utilities, Regional Energy Networks, Community Choice Aggregators, and implementers will need to prepare for rapid measure-package updates, more electrification-oriented portfolios, and a shrinking runway for gas EE programs.

Demand Response

Parties recently submitted reply comments in response to the Commission's new Demand Response docket. Below is a summary of select parties' filings. Across this sample, parties largely agree that California's DR framework must modernize to support reliability, electrification, and affordability, but they diverge on scope and policy priorities.

- CalCCA, SDG&E, SCE, PG&E, Olivine, the California Solar & Storage Association (CALSSA), and others emphasize that DR must expand beyond legacy summer event programs toward multi-hour, multi-season load flexibility integrated with dynamic rates, Virtual Power Plants, electric-vehicle charging, Behind-the-Meter storage, and CAISO market participation. Many (including CalCCA, Olivine, and SDG&E) urge coordination with the CAISO’s Demand & Distributed Energy Market Integration initiative, the Resource Adequacy rulemaking, and statewide planning (Integrated Energy Policy Report, Integrated Resource Planning, transmission).

- Several parties (CalCCA, Olivine, CALSSA, and PG&E) call for reforms to dual-participation rules, better data access, standardized telemetry, and clearer customer-experience improvements to unlock broader DR enrollment. Virtual Power Plant enablement is widely supported, with requests for a flexible policy framework allowing DR/VPP portfolios to stack services and offer grid-responsive capacity.

- Cal Advocates and TURN push back on expanding the proceeding's scope, especially around cost-effectiveness policy, arguing that DR cost-effectiveness rules (including Total Resource Cost Test vs Ratepayer Impact Measure debates) must remain in the Distributed Energy Resources cost-effectiveness rulemaking. They caution against weakening cost-effectiveness screens or diluting protections intended to prevent uneconomic DR programs.

- PG&E and SDG&E emphasize system-integration and implementation complexity. SCE seeks to silo dynamic-rate system upgrades into rate-design applications and limit the breadth of guiding-principle revisions. CALSSA and other DER providers argue the opposite, warning that separating dynamic-rate infrastructure from DR policy will hobble load-flexibility deployment.

Instant Analysis: CCAs, aggregators, DER providers, and even the utilities push for this rulemaking to modernize DR into a flexible, Virtual Power Plant-aligned, multi-service grid asset integrated with dynamic rates, the CAISO’s Demand & Distributed Energy Market Integration work, and Resource Adequacy reform. Parties emphasize better telemetry, dual-participation updates, and customer-experience improvements.

Cal Advocates and TURN act as procedural brakes, insisting the proceeding avoid cost-effectiveness changes. The utilities support modernization conceptually but caution against broad scope expansion.

The filings frame a policy crossroads: whether the CPUC uses this docket to align Demand Response with the state’s evolving DER/VPP ecosystem, or constrains it to prevent uneconomic expansion, even as legacy event-based DR becomes increasingly mismatched to California’s emerging grid realities.

Cost of Capital

PG&E, SCE, SDG&E, and SoCalGas recently met again with CPUC personnel regarding the Commission's pending Cost of Capital PD. (Recall that we also reported on a November 13 meeting here.)

- The investor-owned utilities’ CEOs and senior regulatory executives argued that the PD sets authorized returns on equity below the levels needed to attract sufficient investment in California’s increasingly risky utility environment. They emphasized that catastrophic wildfire exposure (including recent events like the Palisades and Eaton fires) continues to elevate financial and operational risk, and that even after Senate Bill 254, investor uncertainty surrounding inverse condemnation and potential Wildfire Fund depletion remains high.

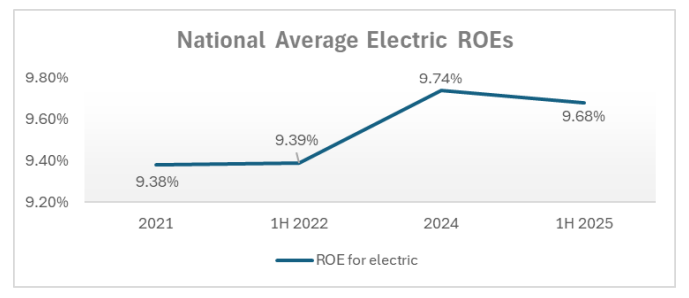

- The utilities stressed that interest rates have risen materially since the 2023 Cost of Capital case, national average ROEs have increased, and shareholder contributions to the Wildfire Fund now further elevate required returns. The utilities provided the following graphic.

- The utilities warned that the PD’s proposed ROEs would worsen the IOUs’ already fragile credit positions, citing recent downgrades and investor reactions, which could increase borrowing costs and ultimately undermine long-term affordability for customers. The utilities asked the Commission to, at minimum, maintain current authorized ROEs rather than reduce them.

An accompanying slide deck details rising market yields, deteriorating credit metrics, elevated wildfire-related financial uncertainty, and analyst commentary describing the PD as surprising, negative, and misaligned with California’s risk profile.

Instant Analysis: At minimum, two major interpretations frame the current Cost of Capital debate.

- Current and emerging risks (many of them California-specific and shaped by the state’s regulatory environment) justify higher ROEs to prevent long-term financing cost increases.

- Persistent rate pressures warrant holding the line or reducing returns, especially amid heightened public affordability concerns.

The central question is then whether the IOUs’ coordinated position reflects a legitimate risk-pricing gap that could elevate long-term costs, or a strategic effort to secure stronger financial conditions under the banner of risk.

Nuclear Decommissioning

SDG&E filed an advice letter (AL 4764-E, available here) to report an upcoming vacancy on its Nuclear Decommissioning Trust Fund Committee. SDG&E explains that the term of committee member Estela de Llanos ended on October 31, 2025, following her resignation from SDG&E.

SDG&E's Board of Directors has selected April Robinson, the company’s Chief Risk and Compliance Officer, as the nominee. In parallel, SDG&E has now submitted an advice letter (AL 4576-E-A) formally requesting CPUC approval of Robinson’s appointment.

Instant Analysis: This matter is a routine housekeeping item, but governance of nuclear decommissioning trust funds is becoming more sensitive as decommissioning timelines accelerate, investment rules evolve, and market volatility raises the stakes for long-duration liabilities. This process also lands against the broader backdrop of a system pursuing large-scale decommissioning while simultaneously tightening its reliability standards. This unresolved tension continues to surface across multiple CPUC proceedings.